Summary

Small businesses should expect steady federal spending in 2026, with strong demand for IT modernization (AI, cloud, data), cybersecurity, software supply-chain assurance, defense modernization/prototyping, and sustainability/domestic sourcing. Agencies to watch: Department of Defense, GSA, DHS, HHS, VA, DOE, and NASA. Adopt federal cyber/AI compliance, pursue GSA vehicles, and build prime/sub partner strategies.

Macro Outlook

- The federal government continues to push targets and scorecards to grow the small-business share of prime contracting; recent SBA scorecards and White House actions signal continued emphasis on meeting and publicizing small-business goals into 2026. Agencies that performed well on scorecards will continue to push opportunities for socio-economic firms.

- Modernization of technology and national security needs mean strong demand for commercial tech (cloud, AI/ML, edge, software), secure software development, and faster prototyping/pilot buys from DoD and civilian agencies. GSA has launched “Buy AI” resources and other initiatives to ease federal AI purchases — a clear path for small AI/IT firms.

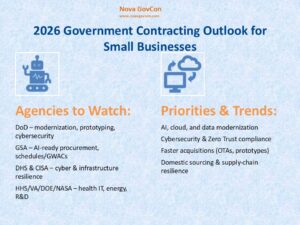

Agencies Small-Businesses Should Watch (Why?)

Department of Defense (DoD) — large budgets, expanding rapid-prototype and acquisition-transformation pathways that favor faster buys and commercial solutions; emphasis on software, autonomy, electronic warfare, and sustainment (including “right to repair”) creates supplier opportunities for SMEs.

General Services Administration (GSA) — controls many contract vehicles (schedules, GWACs) and is actively enabling AI/IT buys and easier access for smaller vendors. Getting onto GSA schedules or GWACs remains high-leverage.

Department of Homeland Security (DHS) & CISA — continuing investments in cyber, identity, and critical infrastructure resilience; expect R&D and services buys that favor small, specialized cyber firms.

HHS / NIH / FDA — strong demand for health IT, data analytics, and medical supply chain resiliency; SBIR/STTR pathways often fund early-stage health tech and biotech small firms.

VA, DOE, NASA — VA for healthcare IT and facilities services; DOE and NASA for clean energy, advanced manufacturing, and research partnerships (opportunities by subcontracting or small-business set-asides).

Key Procurement Priorities & Trends for 2026

AI, cloud, and data modernization — agencies are procuring AI-enabled services and cloud-native solutions; expect stricter acquisition paths and tailored contract language for responsible AI. GSA’s “Buy AI” resources show active onboarding of AI vendors.

Cybersecurity / Zero Trust / Software supply-chain integrity — Executive actions and OMB/CISA guidance mean contracts increasingly require a stronger cybersecurity posture, supply-chain risk mitigation, and specific reporting/certifications. Small firms must prepare to demonstrate security controls and incident response readiness.

Acquisition speed & prototyping — DoD and other agencies are evolving pathways (rapid prototyping, MTA-like approaches, OTA) to field capabilities faster, opening opportunities for commercial small businesses to deliver fast, iterative solutions.

Supply-chain resilience & domestic sourcing — “Buy American,” industrial base strengthening, and right-to-repair/sustainment policies push agencies to source domestically and consider nontraditional manufacturers and repair services. This can benefit small manufacturers and specialty suppliers.

Set-aside & socio-economic programs remain relevant — SBA scorecards show continued focus on small, WOSB, 8(a), SDVOSB, and HUBZone goals — use these programs as entry points.

Practical Recommendations for Small Businesses

Register and verify: SAM.gov registration up to date; ensure NAICS and PSC codes accurately reflect capabilities.

Certify & prepare for cyber: Obtain appropriate cybersecurity attestations (document policies; FedRAMP if offering cloud services; CMMC awareness for defense supply chains; follow OMB/CISA guidance).

Pursue GSA vehicles & “Buy AI” readiness: Evaluate GSA schedule/GWAC entry; prepare AI/system security documentation to meet agency requirements.

Target prototyping/OTAs/SBIR: Compete for small pilot/prototype buys, SBIR/STTR awards, and Other Transaction Authorities, where available — these lower the barriers to innovation buys.

Partner smartly: Build teaming/subcontract relationships with primes, especially in verticals (health, defense, energy). Consider consortia or industry-assistance programs (some large vendors now help smaller firms access DoD).

Highlight supply-chain & sustainment capability: If you can provide domestic manufacturing, repair/maintenance, or localized logistics — emphasize it (agencies are prioritizing resilience).

Recommendation: Prepare Early With Expert Support

As federal priorities evolve and competition intensifies, small businesses must be proactive and well-prepared to navigate federal contracting in 2026. From opportunity targeting and compliance planning to proposal development and certifications, early preparation is essential for success.

Nova GovCon provides tailored, end-to-end support to help small businesses build capacity, strengthen compliance, and compete effectively for federal contracts.

With expertise in GovCon readiness, contract lifecycle management, business reorganization, and federal procurement strategy, Nova GovCon equips businesses to enter the market with confidence.

Small businesses aiming to win more federal work in 2026 should consider partnering with Nova GovCon to ensure they are fully prepared to respond to solicitations, align with agency priorities, and stand out in a highly competitive environment.

Sources (selected)

This report is based on research and findings conducted by Nova GovCon. Key sources used: SBA small business procurement scorecard and guidance; GSA “Buy AI” and procurement announcements; OMB / CISA cybersecurity guidance; DoD acquisition transformation materials and news on DoD procurement shifts; reporting on “right to repair” and industry-assistance programs.